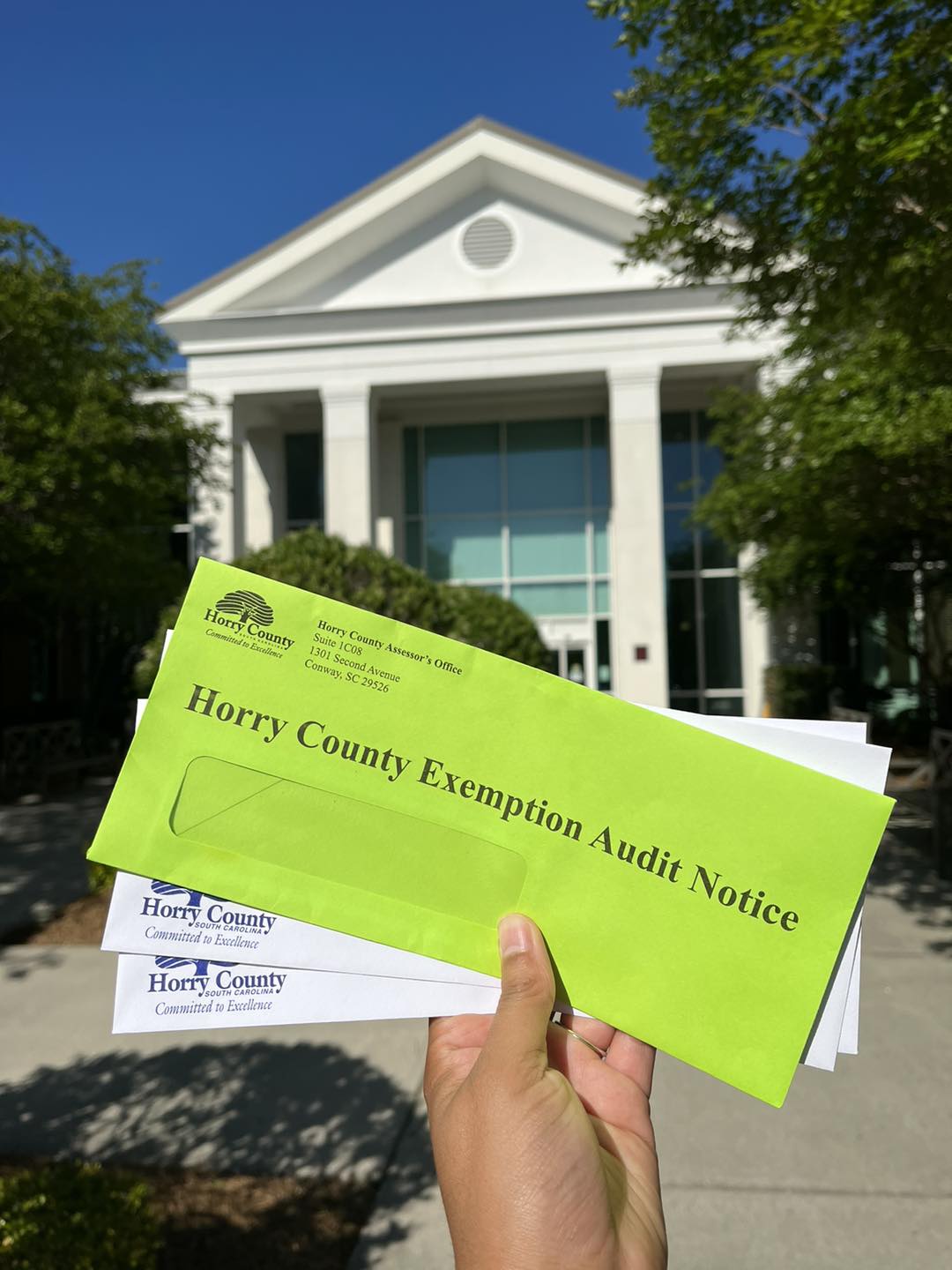

2024 Reassessment: What To Expect

Real property owners in Horry County can expect a few things to happen in a reassessment year.

Certified Horry County appraisers or listers may visit your property. It will be clear that they are county employees, wearing County logos, possessing their County employee ID, and driving county vehicles. They do not need to enter the home to complete their evaluation.

If your property’s assessed value increases by more than $1,000, you can expect to see an assessment notice in the mail during Summer 2024. We ask that you review these notices carefully, as the assessed value directly affects the amount of taxes you may owe. You will have 90 days from the notice date to appeal.

Please note: any increase in the Taxable Value of real property, like your home, is limited to 15% within 5 years, regardless of how much the Fair Market Value as determined by the Assessor grows. However, that limit does not apply to the fair market value of additions or improvements, or assessable transfer of interest (meaning the property was transferred to a new owner. New owners of the property would pay taxes based on the property’s worth at the last date of the previous year).

You can expect to see your property tax bill in early Fall. If you did not receive an assessment notice in the summer, you will have until the payment deadline in January to appeal your property tax bill. All appeals are processed in the order they are received.

IMPORTANT: Homeowners, if you are a permanent resident (meaning you live in your property full time), remember to apply for the ‘legal residence’ or ‘homestead’ exemptions as soon as you acquire the property. You should plan to apply anytime you purchase and move into a different property. This helps ensure your taxes will be at the appropriate rate and limits delays in acquiring the special tax assessment rate. If you already qualify for the property you currently live at, you do not need to reapply. Veterans can apply for particular exemptions at the state level through SCDOR. You can find the links to apply for the legal residence or homestead exemption online at https://www.horrycountysc.gov/tax-payer-services/.

If you have any questions, please reach out to the Assessor’s Office at 843-915-5040 or email hcg.assessor@horrycountysc.gov.

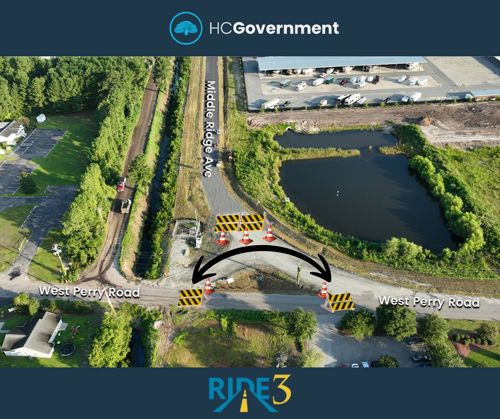

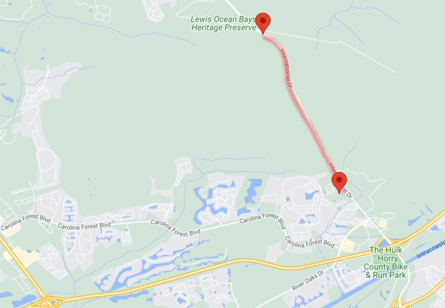

Grand Opening for Middle Ride Avenue Extension Set for May 1, 2024

The grand opening ceremony for the new Myrtle Ridge Avenue Extension is set for 9:30 a.m., Wednesday, May 1, 2024.

The ceremony will take place at the intersection of Middle Ridge Avenue and Myrtle Ridge Drive, in front of the roundabout, accessible from the Walmart side.

Speakers will include Horry County Council, Horry County Administration, 'Road Improvement and Development Effort' (RIDE) program leadership, and project contractors and partners.

Rather than a ribbon-cutting, the event will conclude with a ceremonial barricade removal and the 'first ride' of the new route, as well as light refreshments.

We look forward to seeing you, and highlighting the positve road ahead for our Horry County community.

To stay up-to-date on all matters related to the County, follow the official Horry County Government social media page.

Weekly Update April 22-26, 2024

Upcoming Meetings

Monday, April 22, 2024, 5:30 p.m.

Historic Preservation Commission

Click here for the agenda and packet.

Wednesday, April 24, 2024, 9 a.m.

Accommodations Tax Advisory Committee

Click here for the agenda and packet.

Thursday, April 25, 2024, 3 p.m.

Planning Commission Workshop

Click here for the agenda and packet.

Thursday, April 25, 2024, 4:30 p.m.

Library Board of Trustees

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Joint Gathering Dinner

Members of the Horry County Council and Myrtle Beach City Council will meet for dinner at 6 p.m., Thursday, April 25, 2024, at Swing & Swine in Myrtle Beach, SC.

The dinner is not a formal meeting, and there will be no official actions or votes taken. This is a chance for councilmembers to get to know one another better. No specific discussion topics are planned.

The public is welcome to attend, although dinner is only being served for Council members and senior staff.

Again, no official action will be taken by either Council.

--------------------------------------------

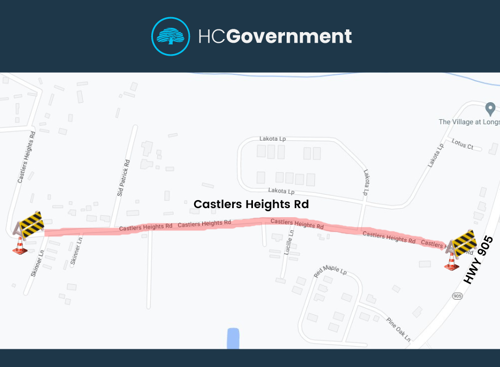

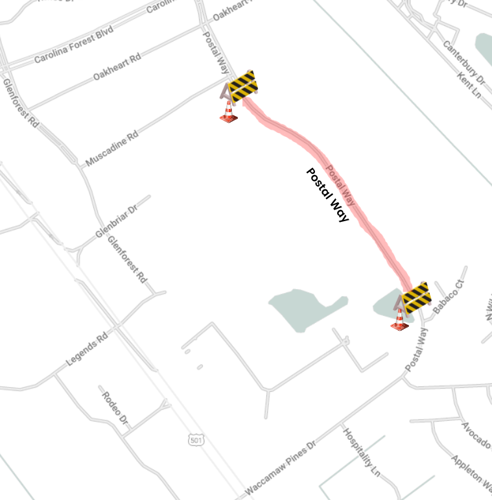

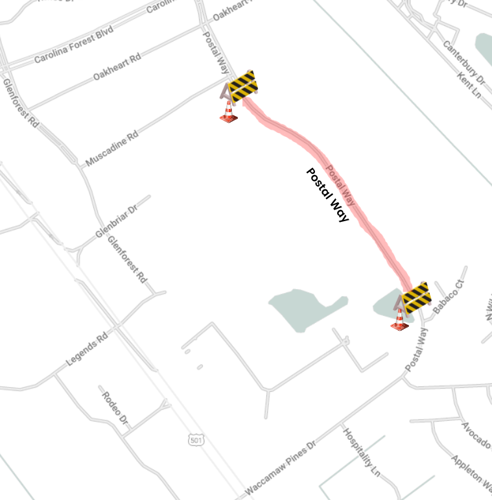

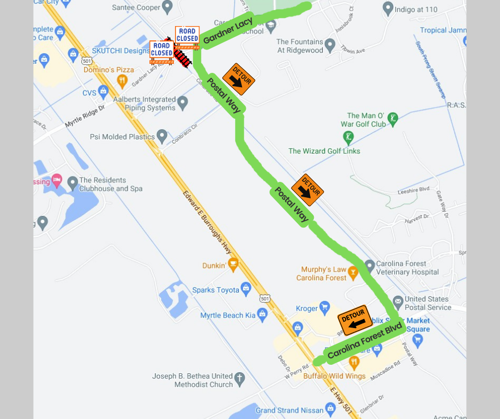

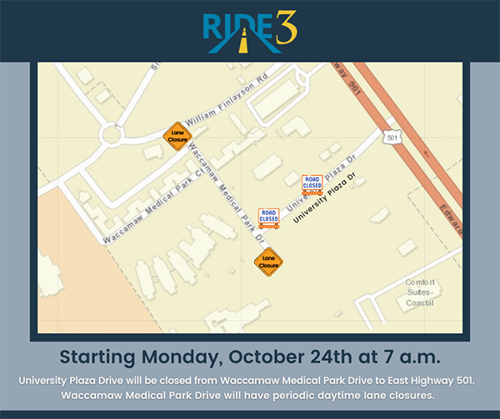

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update March 18-22, 2024

Upcoming Meetings

Monday, March 18, 2024, 11 a.m.

Local Emergency Planning Committee

Click here for the agenda and packet.

Tuesday, March 19, 2024, 9:30 a.m.

Forfeited Land Commission Meeting

Click here for the agenda and packet.

Tuesday, March 19, 2024, 11:30 a.m.

Keep Horry County Beautiful Committee

Click here for the agenda and packet.

Tuesday, March 19, 2024, 6 p.m.

Horry County Council

Click here for the agenda and packet.

Wednesday, March 20, 2024, 10 a.m.

RIDE 4 Sales Tax Commission

Click here for the agenda and packet.

Thursday, March 21, 2024, 9 a.m.

County Council Spring Budget Planning Retreat

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update March 11-15, 2024

Upcoming Meetings

Monday, March 11, 2024, 5:30 p.m.

Zoning Board of Appeals

Click here for the agenda and packet.

Tuesday, March 12, 2024, 9 a.m.

Infrastructure & Regulation Committee

Click here for the agenda and packet.

Tuesday, March 12, 2024, 1 p.m.

Public Safety Committee

Click here for the agenda and packet.

Friday, March 15, 2024, 9:30 a.m.

Vereen Memorial Historical Gardens Committee

Click here for the agenda and packet.

Friday, March 15, 2024, 11 a.m.

Rural Civic Center Meeting

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Horry County Legislative Delegation Seeking Applicants For Boards and Commissions

The Horry County Legislative Delegation is currently seeking applicants for the following boards/commissions that has vacancies, expired terms, or terms that expire in the near future:

- HC Disabilities & Special Needs (Ability Beyond Barriers) Board

- Horry County First Steps

- Horry County Higher Education Commission

- Horry County Board of Social Services

- Horry County Transportation Committee

- Horry County Voter Registration & Elections Board

- Horry/Georgetown Commission on Technical Education

- Grand Strand Water & Sewer Authority Board

- SC Saltwater Recreational Fisheries Advisory Board – Horry County Board

- South Carolina Forestry Commission – Horry County Board

- Waccamaw Center for Mental Health Governing Board

- Waccamaw Regional Transportation Authority

- Waccamaw Regional Council of Governments

We ask that applications be submitted no later than Friday, March 29, 2023.

For those individuals whom are interested in serving on the other boards/commissions, please note the entire application process has changed and is completed digital.

Step 1: Constituents can now access the application via the Delegation page on the Horry County website. The specific link is: https://www.horrycountysc.gov/departments/delegation/boards-and-commissions/. On the right hand side of the page there is a link to the Full Board & Commission application and background check form.

Step 2: Please allow ample time to complete the application process in one sitting. Once the required application page is completed, constituents will receive an automated email from Horry County. They will also receive another email from DocuSign to complete the required background check form.

Step 3: They will also receive another email from DocuSign to complete the required background check form. Once the required background check form is completed, constituents will receive two automated emails: One from DocuSign confirming the completion of the background check form and another from Horry County confirming the application process has been completed.

Weekly Update March 4-8, 2023

Upcoming Meetings

Tuesday, March 5, 2024, 12 p.m.

Parks & Open Space Board

Click here for the agenda and packet.

Tuesday, March 5, 2024, 6 p.m.

County Council

Click here for the agenda and packet.

Thursday, March 7, 2024, 5:30 p.m.

Planning Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

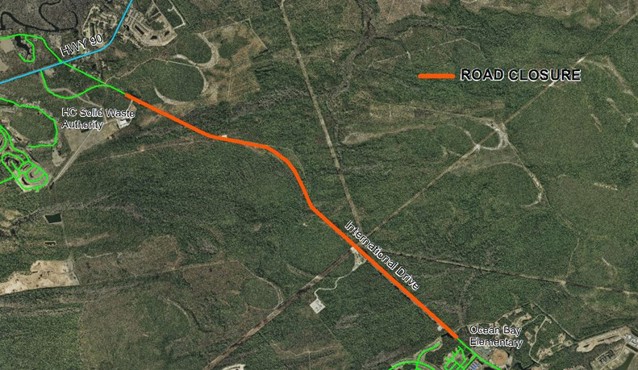

UPDATE 2/28/24: International Drive Reopens & Resumes Normal Traffic Following SCDNR Controlled Burns

As of Feb. 28, 2024, International Drive has reopened and resumed normal traffic flow following controlled burns by South Carolina Department of Natural Resources in the vicinity earlier this week.

Per SCDNR, no more controlled burns are planned for the area the remainder of the week.

While the roadway is now open, there may be lingering smoke that could impact visibility this evening.

Community members are encouraged to use caution while driving nearby.

To stay up-to-date on all matters related to the County, follow the official Horry County Government pages on all social media platform.

----------------------------------------------

Original news release provided below for clarity:

Conway, SC (Feb. 23, 2024) -- The South Carolina Department of Natural Resources (SCDNR) intends to perform controlled burns in the vicinity of International Drive on Monday, Feb. 26, 2024, through Friday, March 1, 2024.

Prescribed burns are set intentionally for purposes of forest management and to prevent uncontrolled forest fires. The controlled burn will reduce the accumulation of flammable fuels on the forest floor under SCDNR's planned land management program.

This controlled burn will require a temporary road closure of International Drive, from SC Highway 90 to Ocean Bay Elementary School, for all traffic.

The closure is expected to go into effect after 8 a.m. Monday, Feb. 26, 2-24, and reopen the evening of Friday, March 1, 2024. This schedule is based on the most current weather forecast and is subject to change.

Law Enforcement will be enforcing the road closure.

Access to the Horry County Solid Waste Authority facility on Highway 90 will remain open but only from SC Highway 90. The community member Recycling Convenience Center on International Drive, by the ballfields, will remain open during normal hours, but only accessible from the SC Highway 31 end of International Drive.

Please plan your travel accordingly. Alternate routes may include US Highway 501 and SC Highway 22.

Weekly Update Feb. 26 - March 1, 2024

Upcoming Meetings

Monday, Feb. 26, 2024, 5:30 p.m.

Historic Preservation Commission

Click here for the agenda and packet.

Thursday, Feb. 29, 2024, 3 p.m.

Planning Commission Workshop

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

RIDE 4 Sales Tax Commission Public Information Meetings Conclude

While the Public Information Meetings for the RIDE 4 Program have concluded, project information, including meeting displays and handouts, are available on the project website at www.horrycountysc.gov/RIDE-4

Sales Tax Program Purpose:

The purpose of this program is to reduce traffic congestion, create new connectivity, and improve traffic safety to better the quality of life for our residents and visitors.

Questions/Comments:

The program website can be found here: www.horrycountysc.gov/RIDE-4

Questions can be sent to RIDE4@horrycountysc.gov

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Reminder: Temporary changes to polling locations for Presidential Preference Primaries

Community members registered to vote in the Republican Presidential Preference Primary are reminded to verify their polling location for the Primary held Saturday, Feb. 24, 2024. Polls will be open 7 a.m. to 7 p.m.

Voters can verify their polling location for the February Presidential Preference Primaries here.

Horry County will see 59 polling sites combined or changed for the Democrat and Republican Presidential Preference Primaries in February.

These changes were made at the direction of the Democrat and Republican parties and the State Election Commission to help save on costs. The changes are allowed under SC Law.

Voters can expect these temporary polling location changes to return to normal locations for the June primaries.

The Democratic Party Presidential Preference Primary was held Saturday, Feb. 3, 2024.

Weekly Update Feb. 19-23, 2024

Upcoming Meetings

Tuesday, Feb. 20, 2024, 6 p.m.

County Council

Click here for the agenda and packet.

Wednesday, Feb. 21, 2024, 10 a.m.

RIDE 4 Sales Tax Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

RIDE 4 Sales Tax Commission Public Information Meetings Conclude

While the Public Information Meetings for the RIDE 4 Program have concluded, project information, including meeting displays and handouts, are available on the project website at www.horrycountysc.gov/RIDE-4

Sales Tax Program Purpose:

The purpose of this program is to reduce traffic congestion, create new connectivity, and improve traffic safety to better the quality of life for our residents and visitors.

Questions/Comments:

For additional information, visit www.horrycountysc.gov

Written comments can be provided in the following ways:

- Email your comment card to RIDE4@horrycountysc.gov

- Fill out a comment card and drop it in the comment box at the Public Information Meeting

- Mail Comment Card to: Horry County Government, c/o RIDE Program, 4401 Privetts Road,Conway, SC 29526

The program website can be found here: www.horrycountysc.gov/RIDE-4

Comments will be accepted through Feb. 18, 2024.

All written comments received during the comment period will be considered and will be included in the record.

--------------------------------------------

Closures & Updates

The Horry County Animal Care Center is closed to the public until at least Friday, March 1, 2024.

During the closure, the HCACC will not be able to conduct in-person adoptions, nor accept owner surrenders or stray intakes.

Ducks and chickens are available to adopt by appointment only. Please call 843-915-5172 to schedule.

Staff will continue to care for all animals on-site for the duration of the closure.

Updates will be provided on the HCACC Facebook page.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Feb. 12-16, 2024

Upcoming Meetings

Monday, Feb. 12, 2024, 5:30 p.m.

Zoning Board of Appeals

Click here for the agenda and packet.

Tuesday, Feb. 13, 2024, 9 a.m.

Infrastructure & Regulation Committee

Click here for the agenda and packet.

Tuesday, Feb. 13, 2024, 1 p.m.

Public Safety Committee

Click here for the agenda and packet.

Thursday, Feb. 15, 2024, 2 p.m.

Administration Committee

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

RIDE 4 Sales Tax Commission Public Information Meetings Continue Across the County

Throughout the remainder of February, the Horry County Sales Tax Commission will continue to host Public Information Meetings to provide details, answer community members, and accept written comments regarding the Commission's recommended transportation projects list.

Completed:

- Tuesday, Jan. 23, 2024, from 4:00 p.m. to 6:00 p.m. at the City of Conway Planning and Construction Services Building (196 Laurel St., Conway, SC 29526)

- Wednesday, Jan. 24, 2024 from 4:00 p.m. to 6:00 p.m. at the City of North Myrtle Beach City Hall Atrium (1018 2nd Ave. S., North Myrtle Beach, SC 29582)

- Thursday, Feb. 1, 2024 from 4:00 p.m. to 6:00 p.m. at the Academy for Technology & Academics (5639 Hwy. 701, Conway, SC 29526)

- Monday, Feb. 5, 2024 from 4:00 p.m. to 6:00 p.m. at the South Strand Recreation Center Multipurpose Room (9650 Scipio Ln., Myrtle Beach, SC 29588)

- Wednesday, Feb. 7, 2024 from 4:00 p.m. to 6:00 p.m. at the James R Frazier Community Center Multipurpose Room (1370 Bucksport Rd., Bucksport SC 29527)

Upcoming:

- Monday, Feb. 12, 2024 from 4:00 p.m. to 6:00 p.m. at the City of Myrtle Beach Train Depot (851 Broadway St., Myrtle Beach, SC 29577)

- Thursday, Feb. 15, 2024 from 4:00 p.m. to 6:00 p.m. at the Carolina Forest Recreation Center Multipurpose Room (2254 Carolina Forest Blvd., Myrtle Beach, SC 29577)

The public information meetings will be open-house style with displays and handouts for viewing.

Citizens will have the opportunity to speak with local and state government representatives and to provide written comments regarding the projects.

For those that cannot attend in person, project information, including meeting displays and handouts, will be available on the project website: www.horrycountysc.gov/RIDE-4

Sales Tax Program Purpose:

The purpose of this program is to reduce traffic congestion, create new connectivity, and improve traffic safety to better the quality of life for our residents and visitors.

Questions/Comments:

For additional information, visit www.horrycountysc.gov

Written comments can be provided in the following ways:

- Email your comment card to RIDE4@horrycountysc.gov

- Fill out a comment card and drop it in the comment box at the Public Information Meeting

- Mail Comment Card to: Horry County Government, c/o RIDE Program, 4401 Privetts Road,Conway, SC 29526

The program website can be found here: www.horrycountysc.gov/RIDE-4

Comments will be accepted through Feb. 18, 2024.

All written comments received during the comment period will be considered and will be included in the record.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Early Voting to be held next week for Presidential Preference Primary

Voters in Horry County will have the chance to take part in early voting for the Republican Presidential Preference Primary Feb. 12 – 22, 2024.

To participate, voters must have registered to vote in the Presidential Preference Primary. The registration deadline was Jan. 25, 2024.

Early voting is held at three locations in Horry County:

- Horry County Voter Registration Office at 1515 4th Ave., Conway, SC 29526

- South Strand Recreation Center at 9650 Scipio Ln., Myrtle Beach, SC 29588

- North Strand Recreation Center at 120 Hwy. 57 S., Little River, SC 29566

Early voting is held 08:30 a.m. to 6 p.m. each day. Polling locations are closed on Sunday, Feb. 18, and Monday, Feb. 19, 2024 (President’s Day).

You can find more information about the Presidential Preference Primaries and early voting here: https://www.horrycountysc.gov/media/hpuoowfz/early-voting-2024-presidential-preference-primaries.pdf

The Democratic Presidential Preference Primary in South Carolina was held on Saturday, Feb. 3, 2024.

Weekly Update Feb. 5-9, 2024

Upcoming Meetings

Monday, Feb. 5, 2024, 9:30 a.m.

Vereen Memorial Historical Gardens Committee

Click here for the agenda and packet.

Tuesday, Feb. 6, 2024, 6 p.m.

County Council

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

RIDE 4 Sales Tax Commission Public Information Meetings Continue Across the County

Throughout January and February 2024, the Horry County Sales Tax Commission will host Public Information Meetings to provide details, answer community members, and accept written comments regarding the Commission's recommended transportation projects list.

Completed:

- Tuesday, Jan. 23, 2024, from 4:00 p.m. to 6:00 p.m. at the City of Conway Planning and Construction Services Building (196 Laurel St., Conway, SC 29526)

- Wednesday, Jan. 24, 2024 from 4:00 p.m. to 6:00 p.m. at the City of North Myrtle Beach City Hall Atrium (1018 2nd Ave. S., North Myrtle Beach, SC 29582)

- Thursday, Feb. 1, 2024 from 4:00 p.m. to 6:00 p.m. at the Academy for Technology & Academics (5639 Hwy. 701, Conway, SC 29526)

Upcoming:

- Monday, Feb. 5, 2024 from 4:00 p.m. to 6:00 p.m. at the South Strand Recreation Center Multipurpose Room (9650 Scipio Ln., Myrtle Beach, SC 29588)

- Wednesday, Feb. 7, 2024 from 4:00 p.m. to 6:00 p.m. at the James R Frazier Community Center Multipurpose Room (1370 Bucksport Rd., Bucksport SC 29527)

- Monday, Feb. 12, 2024 from 4:00 p.m. to 6:00 p.m. at the City of Myrtle Beach Train Depot (851 Broadway St., Myrtle Beach, SC 29577)

- Thursday, Feb. 15, 2024 from 4:00 p.m. to 6:00 p.m. at the Carolina Forest Recreation Center Multipurpose Room (2254 Carolina Forest Blvd., Myrtle Beach, SC 29577)

The public information meetings will be open-house style with displays and handouts for viewing.

Citizens will have the opportunity to speak with local and state government representatives and to provide written comments regarding the projects.

For those that cannot attend in person, project information, including meeting displays and handouts, will be available on the project website: www.horrycountysc.gov/RIDE-4

Sales Tax Program Purpose:

The purpose of this program is to reduce traffic congestion, create new connectivity, and improve traffic safety to better the quality of life for our residents and visitors.

Questions/Comments:

For additional information, visit www.horrycountysc.gov

Written comments can be provided in the following ways:

- Email your comment card to RIDE4@horrycountysc.gov

- Fill out a comment card and drop it in the comment box at the Public Information Meeting

- Mail Comment Card to: Horry County Government, c/o RIDE Program, 4401 Privetts Road,Conway, SC 29526

Beginning Jan. 23, 2024, the program website can be found here: www.horrycountysc.gov/RIDE-4

Comments will be accepted through Feb. 18, 2024.

All written comments received during the comment period will be considered and will be included in the record.

--------------------------------------------

Joint Luncheon - Feb. 7, 2024

The Horry County Board of Education will host a joint luncheon with Horry County Council on Feb. 7, 2024, at 11:30 a.m. at the Academy for Technology and Academics.

The luncheon is not a formal meeting with official actions or votes, but rather a social-only chance for the board and council members to get to know one another.

No specific discussion topics are planned and as such no agenda will be used.

We provide this notice in compliance with the South Carolina Freedom of Information Act. Again, no official action will be taken by either body.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Temporary change to polling locations for Presidential Preference Primaries

Reminder: Horry County will see 59 polling sites combined or changed for the Democrat and Republican Presidential Preference Primaries in February.

These changes are based on guidance from the Democrat and Republican Parties and the State Election Commission. These temporary precinct changes will return to normal locations for the June primaries.

The affected precincts and their temporary voting locations for the Presidential Preference Primaries can be found under “PPP Precincts Combined” here.

The Democratic Party Presidential Preference Primary is set for Saturday, Feb. 3, 2024. The Republican Party Presidential Preference Primary is set for Saturday, Feb. 24, 2024. Polling locations will be open from 7 a.m. to 7 p.m.

Weekly Update Jan. 29 - Feb. 2, 2024

Upcoming Meetings

Tuesday, Jan. 30, 2024, 11:30 a.m.

Keep Horry County Beautiful

Click here for the agenda and packet.

Thursday, Feb. 1, 2024, 5:30 p.m.

Planning Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

RIDE 4 Sales Tax Commission Public Information Meetings Continue Across the County

Throughout January and February 2024, the Horry County Sales Tax Commission will host Public Information Meetings to provide details, answer community members, and accept written comments regarding the Commission's recommended transportation projects list.

Completed:

- Tuesday, Jan. 23, 2024, from 4:00 p.m. to 6:00 p.m. at the City of Conway Planning and Construction Services Building (196 Laurel St., Conway, SC 29526)

- Wednesday, Jan. 24, 2024 from 4:00 p.m. to 6:00 p.m. at the City of North Myrtle Beach City Hall Atrium (1018 2nd Ave. S., North Myrtle Beach, SC 29582)

Upcoming:

- Thursday, Feb. 1, 2024 from 4:00 p.m. to 6:00 p.m. at the Academy for Technology & Academics (5639 Hwy. 701, Conway, SC 29526)

- Monday, Feb. 5, 2024 from 4:00 p.m. to 6:00 p.m. at the South Strand Recreation Center Multipurpose Room (9650 Scipio Ln., Myrtle Beach, SC 29588)

- Wednesday, Feb. 7, 2024 from 4:00 p.m. to 6:00 p.m. at the James R Frazier Community Center Multipurpose Room (1370 Bucksport Rd., Bucksport SC 29527)

- Monday, Feb. 12, 2024 from 4:00 p.m. to 6:00 p.m. at the City of Myrtle Beach Train Depot (851 Broadway St., Myrtle Beach, SC 29577)

- Thursday, Feb. 15, 2024 from 4:00 p.m. to 6:00 p.m. at the Carolina Forest Recreation Center Multipurpose Room (2254 Carolina Forest Blvd., Myrtle Beach, SC 29577)

The public information meetings will be open-house style with displays and handouts for viewing.

Citizens will have the opportunity to speak with local and state government representatives and to provide written comments regarding the projects.

For those that cannot attend in person, project information, including meeting displays and handouts, will be available on the project website: www.horrycountysc.gov/RIDE-4

Sales Tax Program Purpose:

The purpose of this program is to reduce traffic congestion, create new connectivity, and improve traffic safety to better the quality of life for our residents and visitors.

Questions/Comments:

For additional information, visit www.horrycountysc.gov

Written comments can be provided in the following ways:

- Email your comment card to RIDE4@horrycountysc.gov

- Fill out a comment card and drop it in the comment box at the Public Information Meeting

- Mail Comment Card to: Horry County Government, c/o RIDE Program, 4401 Privetts Road,Conway, SC 29526

Beginning Jan. 23, 2024, the program website can be found here: www.horrycountysc.gov/RIDE-4

Comments will be accepted through Feb. 18, 2024.

All written comments received during the comment period will be considered and will be included in the record.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Jan. 22-26, 2024

Upcoming Meetings

Monday, Jan. 22, 2024, 5:30 p.m.

Historic Preservation Commission

Click here for the agenda and packet.

Thursday, Jan. 25, 2024, 3 p.m.

Planning Commission Workshop

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

RIDE 4 Sales Tax Commission Holds Public Information Meetings

Throughout January and February 2024, the Horry County Sales Tax Commission will host Public Information Meetings to provide details, answer community members, and accept written comments regarding the Commission's recommended transportation projects list.

The first two meetings will be Jan. 23, 2024, at the City of Conway Planning and Construction Services Building, and Jan. 24, 2024, at the City of North Myrtle Beach City Hall Atrium.

For more details about these meetings and others to come, click here: https://www.horrycountysc.gov/news/34913

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

RIDE 4 Sales Tax Commission Announces Public Information Meetings

Throughout January and February 2024, the Horry County Sales Tax Commission will host Public Information Meetings to provide details, answer community members, and accept written comments regarding the Commission's recommended transportation projects list.

Meetings will occur on the following dates at the listed locations:

- Tuesday, Jan. 23, 2024, from 4:00 p.m. to 6:00 p.m. at the City of Conway Planning and Construction Services Building (196 Laurel St., Conway, SC 29526)

- Wednesday, Jan. 24, 2024 from 4:00 p.m. to 6:00 p.m. at the City of North Myrtle Beach City Hall Atrium (1018 2nd Ave. S., North Myrtle Beach, SC 29582)

- Thursday, Feb. 1, 2024 from 4:00 p.m. to 6:00 p.m. at the Academy for Technology & Academics (5639 Hwy. 701, Conway, SC 29526)

- Monday, Feb. 5, 2024 from 4:00 p.m. to 6:00 p.m. at the South Strand Recreation Center Multipurpose Room (9650 Scipio Ln., Myrtle Beach, SC 29588)

- Wednesday, Feb. 7, 2024 from 4:00 p.m. to 6:00 p.m. at the James R Frazier Community Center Multipurpose Room (1370 Bucksport Rd., Bucksport SC 29527)

- Monday, Feb. 12, 2024 from 4:00 p.m. to 6:00 p.m. at the City of Myrtle Beach Train Depot (851 Broadway St., Myrtle Beach, SC 29577)

- Thursday, Feb. 15, 2024 from 4:00 p.m. to 6:00 p.m. at the Carolina Forest Recreation Center Multipurpose Room (2254 Carolina Forest Blvd., Myrtle Beach, SC 29577)

The public information meetings will be open-house style with displays and handouts for viewing.

Citizens will have the opportunity to speak with local and state government representatives and to provide written comments regarding the projects.

For those that cannot attend in person, project information, including meeting displays and handouts, will be available on the project website: www.horrycountysc.gov/RIDE-4

Sales Tax Program Purpose:

The purpose of this program is to reduce traffic congestion, create new connectivity, and improve traffic safety to better the quality of life for our residents and visitors.

Questions/Comments:

For additional information, visit www.horrycountysc.gov

Written comments can be provided in the following ways:

- Email your comment card to RIDE4@horrycountysc.gov

- Fill out a comment card and drop it in the comment box at the Public Information Meeting

- Mail Comment Card to: Horry County Government, c/o RIDE Program, 4401 Privetts Road,Conway, SC 29526

Beginning Jan. 23, 2024, the program website can be found here: www.horrycountysc.gov/RIDE-4

Comments will be accepted through Feb. 18, 2024.

All written comments received during the comment period will be considered and will be included in the record.

Ways to Watch - Temporary Service Change

Due to a temporary vendor issue, the Jan. 16, 2024 meeting of Horry County Council will not be livestreamed to the County Videos webpage.

The County Council Meeting livestream will still be available on the following:

- Horry County Government Facebook page

- Horry County Roku and Apple TV channels

- Government access television channel (Spectrum/Time Warner channel 1301 and Horry Telephone Cooperative Channel 14)

County Closed Jan. 9, 2024 Due to Storm System

Horry County Government's offices and facilities will be closed, Tuesday, Jan. 9, 2024, due to a storm system that will bring rain and strong winds to the area.

Horry County Solid Waste Authority facilities will also be closed, and Parks & Recreation and Library programs canceled on Tuesday.

Public safety departments will continue to provide critical services.

Myrtle Beach International Airport remains open but passengers should check the status of their flights with their airlines.

Normal operations are anticipated to resume on Wednesday, Jan. 10, 2024.

Residents may continue to do business with Horry County departments at any time on the county's website at www.horrycountysc.gov

Community members are encouraged to stay weather aware. For storm updates, please follow Horry County Emergency Management on Facebook.

County Council Declares Local State of Emergency

Horry County Council has declared a localized state of emergency to adopt emergency ordinances to meet public emergencies affecting life, health, safety or the property of the people in our area.

The declaration will remain in effect for sixty (60) days unless sooner terminated by resolution by County Council.

Click here to review the ordinance.

Additional information can be found on Horry County’s website at www.horrycountysc.gov

Horry County Emergency Management Facebook: https://www.facebook.com/horrycountyemergencymanagementdepartment

Horry County Emergency Management Twitter: https://twitter.com/HorryEMD

Property tax payments due January 15, 2024

The due date for property tax payments in Horry County is approaching.

Real estate tax payments are due January 15, 2024. Tax bills were sent in October 2023.

Everyone has the right to appeal until the tax due date. Appeals are processed in the order they are received.

If you have questions about your property tax bill, visit tax payer services here or contact the Assessor’s Office at 843-915-5040. Callers who opt to speak with a customer service representative may encounter delays. Please be patient as staff work diligently to address the needs of all callers and office visitors.

Weekly Update Jan. 1-5, 2024

All Horry County Government offices, except Public Safety operations, are closed Monday, Jan. 1, 2024, in observance of New Year's Day. Normal operations and office hours will resume Tuesday, Jan. 2, 2024.

Stay safe and we will see you again soon.

--------------------------------------------

Upcoming Meetings

Tuesday, Jan. 2, 2024, 6 p.m.

County Council

Click here for the agenda and packet.

Thursday, Jan. 4, 2024, 5:30 p.m.

Planning Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Upcoming Holiday Closure - Martin Luther King Jr. Day

Horry County Government offices, except Public Safety operations, will be closed Monday, Jan. 15, 2024, in observance of Martin Luther King Jr. Day.

Normal operations and office hours will resume Tuesday, Jan. 16, 2024.

Those who may have time-sensitive business to conduct with the County are encouraged to plan to visit or speak with the relevant department before or after the closure.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Postal Service Error Impacts Tax Payments

Due to an error with the U.S. Postal Service, mail recently sent to the Horry County Treasurer's Office tax payment mail box (PO Box 1780, Conway, SC) may have been returned as “Undeliverable” or “Box has closed”.

The Horry County Treasurer's Office is in communication with the USPS and staff are working to get the error corrected.

In the meantime, community members can mail tax payments to Horry County Treasurer, PO Box 1237, Conway, SC 29528.

Community members can also visit the Horry County Taxpayer Services webpage 24/7 or visit one of the four Treasurer's Office locations to make your payment in-person during regular business hours.

We apologize for any inconvenience.

Weekly Update Dec. 25-29, 2023

All Horry County Government offices, except Public Safety operations, are closed Friday, Dec. 22, 2023, through Tuesday, Dec. 26, 2023, for Christmas. Normal operations and office hours will resume Wednesday, Dec. 27, 2023.

Stay safe and we will see you again soon.

--------------------------------------------

Upcoming Meetings

There are no official meetings scheduled for the week of Dec. 25-29, 2023.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Upcoming Holiday Closure - New Year's Day 2024

Horry County Government offices, except Public Safety operations, will be closed Monday, Jan. 1, 2024, in observance of New Year's Day.

Normal operations and office hours will resume Tuesday, Jan. 2, 2024.

Those who may have time-sensitive business to conduct with the County are encouraged to plan to visit or speak with the relevant department before or after the holiday closure.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Dec. 18-22, 2023

Upcoming Meetings

Thursday, Dec. 12, 2023, 6 p.m.

RIDE IV Sales Tax Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Upcoming Holiday Closure - Christmas 2023

Horry County Government offices, except Public Safety operations, will be closed Friday, Dec. 22, 2023, through Tuesday, Dec. 26, 2023, in observance of the Christmas holiday.

Normal operations and office hours will resume Wednesday, Dec. 27, 2023.

Those who may have time-sensitive business to conduct with the County are encouraged to plan to visit or speak with the relevant department before or after the holiday closure.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Horry County Government Offices and Facilities to Open with Delay Due to Storm Impacts

“Home for the Pawlidays” holiday foster program continues in December

After a successful Thanksgiving ‘pawliday’ foster program, the Horry County Animal Care Center will host a second, extended event of the Home for the Pawlidays holiday foster program in December.

This program allows community members to bring a shelter animal home for a temporary foster period over the winter holiday season.

Interested fosters can visit the Animal Care Center from December 19-21, or December 23, 2023 to pick up a foster pet during normal shelter hours. Then, fosters can return the furry holiday guest to the Animal Care Center from Dec. 27-29, 2023, or make it a permanent adoption.

“After the success of the Thanksgiving holiday program and feedback from our community, we decided to extend the program’s pick-up to four days, including a Saturday opportunity. We hope the extension allows more of our community the chance to foster an animal and change a life this holiday season.” Brittany Martin, Office Manager, said.

Fosters are an invaluable part of the ACC’s shelter operation. In general, fosters provide shelter pets with a break from the noise of the shelter. Fostering also helps shelter staff learn more about the animal, in ways that may not be possible in a shelter environment.

Over the 2023 Thanksgiving Holiday, 7 dogs were fostered. Of those, 3 were adopted by their foster families and 4 were adopted after they were returned.

“Fostering is a rewarding experience that can change the lives of the shelter animal, those fostering the animal, and any future adopters.” Horry County Police Lt. Kevin Cast said. “We encourage the community to consider opening their hearts and homes to an animal in need this holiday season if they are able to do so.”

The Horry County Animal Care Center is open Monday through Friday, 10:30 a.m. to 4:30 p.m. (with an hour closure at 12:30 p.m.), and Saturdays, 10:30 a.m. to 12:30 p.m.

Follow the Animal Care Center on Facebook for updates.

You can find more information about the Horry County Animal Care Center, including an up-to-date list of adoptables here.

Property Tax payments due January 2024

Reminder for property owners – property tax payments are due January 15, 2024.

Property tax bills were sent to owners in October 2023. Everyone has the right to appeal until January 15, 2024. Appeals are processed in the order they are received.

The property tax bill is the final one at the current value before reassessment in 2024. All property in Horry County will be reassessed in 2024.

Questions about your tax bill? Contact Tax Payer Services here or call 843-915-8888. Callers who opt to speak with a customer service representative may encounter delays. Please be patient as staff work diligently to address the needs of all callers.

Property owners can also find a complete guide to real property and assessment on the Horry County website.

If you are new to Horry County and own and live full-time in the home or have moved to a new home and own and live full-time in the home, you will have to re-apply for the legal residence tax rate (4%). This only applies if you have a new address in Horry County. Your legal residence status applies for as long as you live at the property. You can learn more about that under ‘Legal Residence’ here.

Weekly Update Dec. 11-15, 2023

Upcoming Meetings

Monday, Dec. 11, 2023, 9 a.m.

County Council Fall Budget Planning Retreat

Click here for the agenda and packet.

Tuesday, Dec. 12, 2023, 6 p.m.

County Council

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Upcoming Holiday Closure - Christmas 2023

Horry County Government offices, except Public Safety operations, will be closed Friday, Dec. 22, 2023, through Tuesday, Dec. 26, 2023, in observance of the Christmas holiday.

Normal operations and office hours will resume Wednesday, Dec. 27, 2023.

Those who may have time-sensitive business to conduct with the County are encouraged to plan to visit or speak with the relevant department before or after the holiday closure.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Dec. 4-8, 2023

Upcoming Meetings

Tuesday, Dec. 5, 2023, 9 a.m.

Infrastructure & Regulation Committee

Click here for the agenda and packet.

Thursday, Dec. 7, 2023, 5:30 p.m.

Planning Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Upcoming Holiday Closure - Christmas 2023

Horry County Government offices, except Public Safety operations, will be closed Friday, Dec. 22, 2023, through Tuesday, Dec. 26, 2023, in observance of the Christmas holiday.

Normal operations and office hours will resume Wednesday, Dec. 27, 2023.

Those who may have time-sensitive business to conduct with the County are encouraged to plan to visit or speak with the relevant department before or after the holiday closure.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Nov. 27 - Dec. 1, 2023

Upcoming Meetings

Monday, Nov. 27, 2023, 5:30 p.m.

Historic Preservation Commission

Click here for the agenda and packet.

Tuesday, Nov. 28, 2023, 11:30 a.m.

Keep Horry County Beautiful Committee

Click here for the agenda and packet.

Tuesday, Nov. 28, 2023, 1 p.m.

Administration Committee

Click here for the agenda and packet.

Thursday, Nov. 30, 2023, 3 p.m.

Planning Commission Workshop

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Upcoming Holiday Closure - Christmas 2023

Horry County Government offices, except Public Safety operations, will be closed Friday, Dec. 22, 2023, through Tuesday, Dec. 26, 2023, in observance of the Christmas holiday.

Normal operations and office hours will resume Wednesday, Dec. 27, 2023.

Those who may have time-sensitive business to conduct with the County are encouraged to plan to visit or speak with the relevant department before or after the holiday closure.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Bring an animal "Home for the Pawlidays" with Animal Care Center's foster program

The Horry County Animal Care Center hosts the Home for the Pawlidays holiday foster program for the second consecutive year.

Interested fosters can join the Animal Care Center on Wednesday, November 22, 2023, to pick up a shelter animal to spend the Thanksgiving holiday with. Then, fosters can return the animal on Monday, November 27, 2023, or make it a permanent adoption, if you have fallen in love. The same program will repeat over the Christmas holiday in December.

This program allows community members to bring home a shelter animal for a temporary foster period over the winter holiday season. In the first year of the event, 20 shelter animals were fostered. 10 of those turned into permanent adoptions.

The hope is to give anxious animals a break from the noise of the shelter. The ACC also hopes the program will bring the joy of having a pet to more community members, including those who love animals but may not be in a position to adopt right now.

Fosters are an invaluable part of the ACC's operation. By fostering or adopting an animal from the Animal Care Center, you are opening a space for another animal who may need help. Can you open your heart and home to an animal in need?

Weekly Update Nov. 20-24, 2023

All Horry County Government offices, except Public Safety operations, will be closed Thursday, Nov. 23, 2023, through Sunday, Nov. 26, 2023, in observance of the Thanksgiving holiday.

Normal operations and office hours will resume Monday, Nov. 27, 2023.

Happy Thanksgiving to you and yours. Stay safe and we will see you again soon.

--------------------------------------------

Upcoming Meetings

There are no official meetings scheduled for the week of Nov. 20-24, 2023.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Nov. 12-17, 2023

Upcoming Meetings

Sunday, Nov. 12, 2023, 1 p.m.

Vereen Memorial Historical Gardens Committee

Click here for the agenda and packet.

Tuesday, Nov. 14, 2023, 10 a.m.

Parks & Open Space Board

Click here for the agenda and packet.

Tuesday, Nov. 14, 2023, 6 p.m.

County Council

Click here for the agenda and packet.

Wednesday, Nov. 15, 2023, 3 p.m.

Stormwater Advisory Board

Click here for the agenda and packet.

Friday, Nov. 17, 2023, 3 p.m.

Committee on Mental Health

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Horry County Government Lifts Burning Ban

Conway, South Carolina (November 6, 2023)—Effective immediately, Horry County Government has lifted the outdoor burning ban for the unincorporated areas of Horry County. We ask you to continue to follow all regulations set forth in the Horry County ordinance regarding open burning. More information about open burning in Horry County can be found here: https://www.horrycountysc.gov/departments/fire-rescue/open-burning/.

As a reminder, all open burning in Horry County requires you to contact the South Carolina Forestry Commission at 1-800-986-5404, before the burn is started.

Even when the burning ban is not in place, we ask for consideration and due diligence when actively involved in open burning. Always remember to lean on the side of safety, and do not burn in windy or dry conditions.

-END-

Weekly Update Nov. 6-10, 2023

All Horry County Government offices, except Public Safety operations, will be closed Friday, Nov. 10, 2023, in observance of Veterans Day.

Normal operations and office hours will resume Monday, Nov. 13, 2023.

Stay safe and we will see you again soon.

--------------------------------------------

Upcoming Meetings

Tuesday, Nov. 7, 2023, 9 a.m.

Infrastructure & Regulation Committee

Click here for the agenda and packet.

Tuesday, Nov. 7, 2023, 1 p.m.

Public Safety Committee

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Oct. 30 - Nov. 3, 2023

Upcoming Meetings

Tuesday, Oct. 31, 2023, 11:30 a.m.

Keep Horry County Beautiful

Click here for the agenda and packet.

Thursday, Nov. 2, 2023, 5:30 p.m.

Planning Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Horry County Initiates Burning Ban Until Further Notice

Conway, South Carolina (Oct. 31, 2023)—Due to current weather conditions, Horry County Government has initiated an outdoor burning ban effective sunrise Wednesday, Nov. 1, for the unincorporated areas of Horry County. This ban will remain in place until further notice. The ban has been initiated due to the extreme fire danger as a result of the low relative humidity, dry and windy conditions. All outdoor burning, including permitted burns, is strictly prohibited during the ban, and those involved in any open burning would be in violation of the law.

For more information on the status of the burning ban, visit horrycountysc.gov/departments/fire-rescue/.

-END-

Employee of the Quarter Awards

On Wednesday, Oct. 25, 2023, Horry County Government held its Employee of the Quarter awards to celebrate County employees who have gone above and beyond in their service to our community.

Winners include:

Jamie (Stormwater) - Infrastructure and Regulation Division

David (Airport) - Administration Division

Schuyler (Horry County 911) - Public Safety Division

We congratulate all of our winners and nominees, and thank them for their hard work and dedication to Horry County!

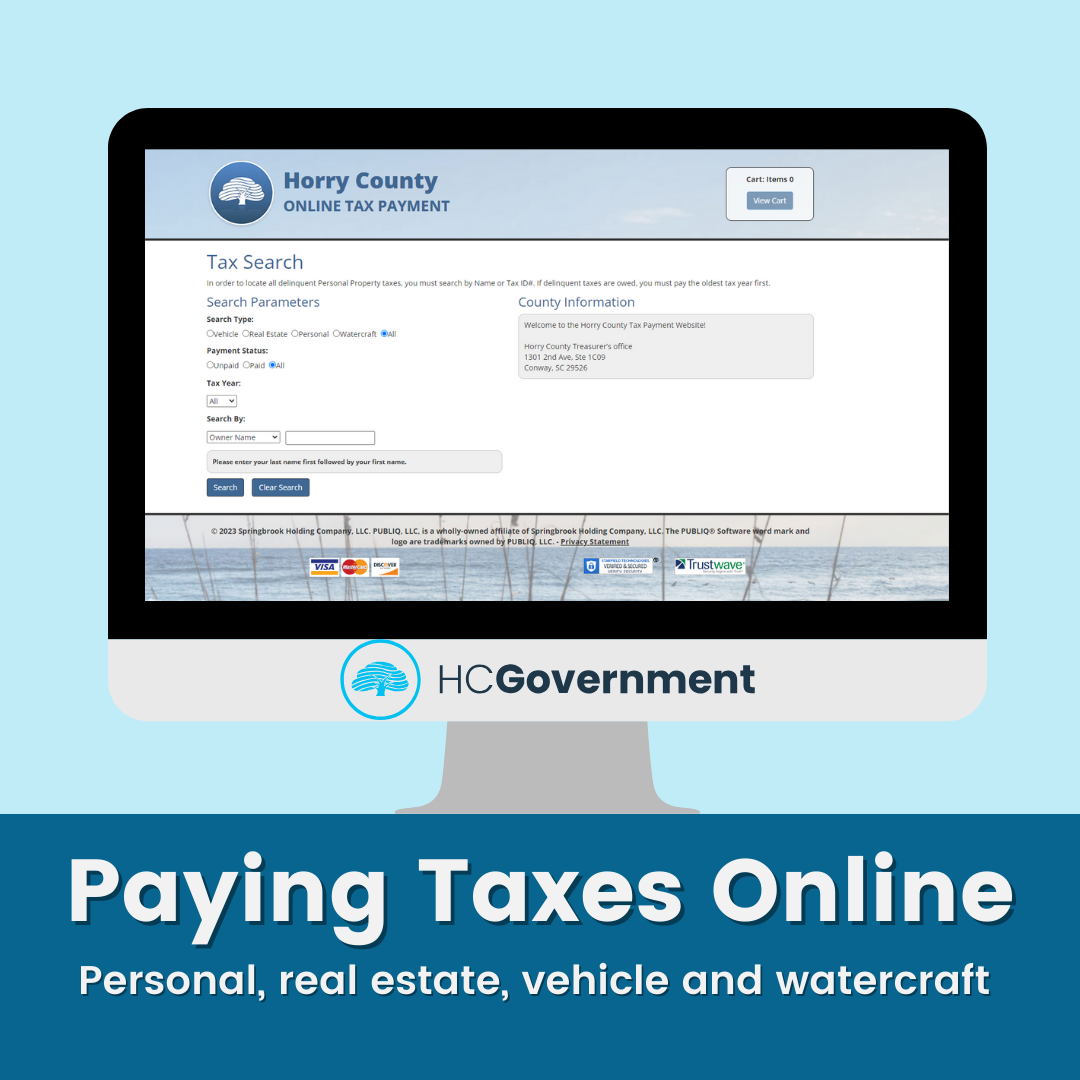

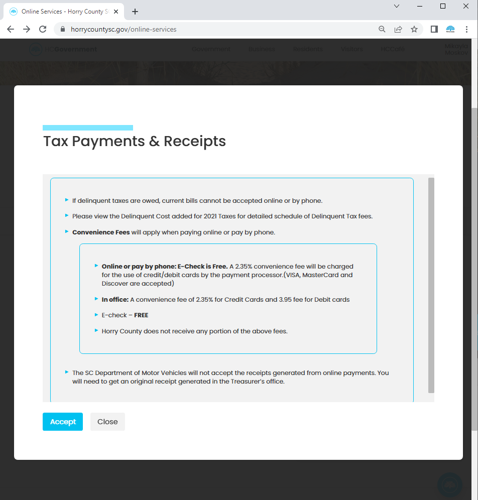

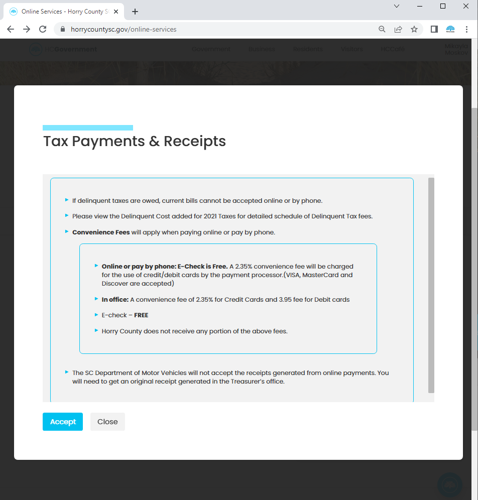

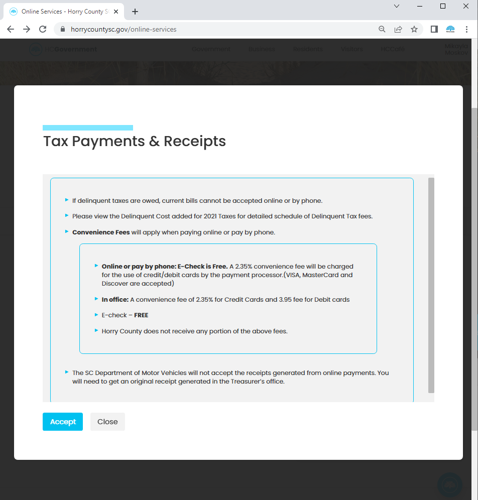

Paying Taxes Online

In Horry County, different tax payments may be due throughout the year, including vehicle, personal, watercraft and real estate tax.

For convenience, these tax payments can be made through the online portal here.

Online payments can be made using e-check, credit or debit card. There is a convenience fee for paying by card online.

A link to pay taxes online can be found on the Horry County website homepage, by clicking ‘I want to pay my taxes’.

Keep in mind, any delinquent tax owed must be paid before paying any current tax owed. Also, the SC Department of Motor Vehicles (SCDMV) will not accept the receipts generated from online payments. The SCDMV requires an original receipt generated in the Treasurer’s office.

Please contact Tax Payer Services or the relevant department with any questions about taxes owed or the payment process.

Weekly Update Oct. 23-27, 2023

Upcoming Meetings

Monday, Oct. 23, 2023, 5:30 p.m.

Historic Preservation Committee

Click here for the agenda and packet.

Tuesday, Oct. 24, 2023, 1 p.m.

Administration Committee

Click here for the agenda and packet.

Thursday, Oct. 26, 2023, 3 p.m.

Planning Commission Workshop

Click here for the agenda and packet.

Thursday, Oct. 26, 2023, 4:30 p.m.

Library Board of Trustees

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

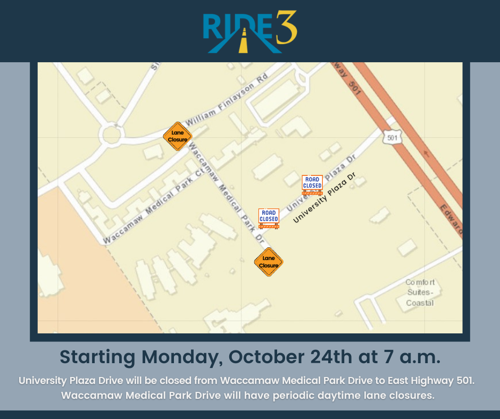

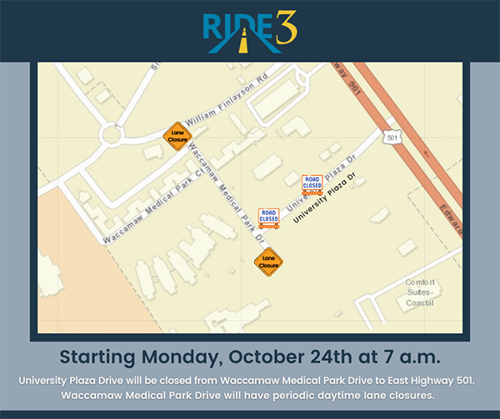

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Welcome to Horry County, DC BLOX

On Tuesday, Oct. 10, 2023, Horry County Council and Staff joined with Myrtle Beach Regional Economic Development Corporation, City of Myrtle Beach, and other partners to commemorate the grand opening of the DC BLOX facility within the Myrtle Beach International Technology & Aerospace Park (ITAP).

As Governor McMaster, County Council Chairman Johnny Gardner, and Myrtle Beach Mayor Brenda Bethune shared in their remarks, the introduction of DC BLOX represents another step toward increasing the Horry County community’s global presence and future opportunities.

DC BLOX is a data storage company that provides the digital infrastructure for international communications. The ITAP facility is equipped to host multiple subsea cables—the first of their kind in South Carolina—as well as traditional workspaces for the necessary network and cable operators, communications providers, local enterprises and partners.

Among those who use the local DC BLOX digital infrastructure are Google and Meta.

“The tech hub DC BLOX is creating is preparing our County for the future. Congratulations on your new facility in Horry County,” said Gardner.

---

The full DC BLOX news release can be found here.

Weekly Update Oct. 16-20, 2023

Upcoming Meetings

Monday, Oct. 16, 2023, 10 a.m.

Local Emergency Planning Committee Meeting

Click here for the agenda and packet.

Tuesday, Oct. 17, 2023, 6 p.m.

County Council

Click here for the agenda and packet.

Wednesday, Oct. 18, 2023, 10 a.m.

RIDE IV Sales Tax Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Oct. 9-13, 2023

Upcoming Meetings

Monday, Oct. 9, 2023, 5:30 p.m.

Zoning Board of Appeals

Click here for the agenda and packet.

Tuesday, Oct. 10, 2023, 9 a.m.

Infrastructure & Regulation Committee

Click here for the agenda and packet.

Tuesday, Oct. 10, 2023, 1 p.m.

Public Safety Committee

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Joint Gathering Dinner - Oct. 12, 2023

Members of the Horry County Council and Myrtle Beach City Council will meet for dinner next week.

The dinner begins at 6 p.m., Thursday, Oct. 12, 2023, at the Cypress Inn, 16 Elm St., Conway, SC 29526.

The dinner is not a formal meeting with official actions or votes, but a chance for the councilmembers to get to know one another. No specific discussion topics are planned. Instead, members of the two councils will share a meal and chat informally as individuals.

The public is welcome to attend, although dinner is only being served for the Council members and senior staff.

We provide this notice in compliance with the South Carolina Freedom of Information Act. Again, no official action will be taken by either Council.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Oct. 2-6, 2023

Upcoming Meetings

Tuesday, Oct. 3, 2023, 12 p.m.

Parks and Open Space Board

Click here for the agenda and packet.

Tuesday, Oct. 3, 2023, 6 p.m.

County Council

Click here for the agenda and packet.

Thursday, Oct. 5, 2023, 5:30 p.m.

Planning Commission

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Sept. 25-29, 2023

Upcoming Meetings

Monday, Sept. 25, 2023, 9 a.m.

Forfeited Land Commission

Click here for the agenda and packet.

Monday, Sept. 25, 2023, 5:30 p.m.

Historic Preservation Commission

Click here for the agenda and packet.

Tuesday, Sept. 26, 2023, 1 p.m.

Administration Committee

Click here for the agenda and packet.

Thursday, Sept. 28, 2023, 3 p.m.

Planning Commission Workshop

Click here for the agenda and packet.

Thursday, Sept. 28, 2023, 4:30 p.m.

Library Board of Trustees

Click here for the agenda and packet.

Thursday, Sept. 28, 2023, 6:30 p.m.

Vereen Memorial Historical Garden Committee

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Treasurer's Office Closing Early Friday, Sept. 22, 2023

The Horry County Treasurer's Office will be closing at 12 p.m. on Friday, Sept. 22, 2023, for a staff meeting.

Online tax payer services will remain available at https://www.horrycountysc.gov/tax-payer-services

Horry County Government also has an automated Tax Services Hotline that allows community members to get information about their taxes 24/7.

Call 843-915-8888 to get answers for many common questions about tax payer services, including payment options and locations.

Weekly Update Sept. 18-22, 2023

Upcoming Meetings

Tuesday, Sept. 19, 2023, 11:30 a.m.

Keep Horry County Beautiful

Click here for the agenda and packet.

Tuesday, Sept. 19, 2023, 2:00 p.m.

Impact Fee Workshop

Click here for the agenda and packet.

Tuesday, Sept. 19, 2023, 6:00 p.m.

County Council

Click here for the agenda and packet.

Wednesday, Sept. 20, 2023, 10 a.m.

RIDE IV Sales Tax Commission

Click here for the agenda and packet.

Wednesday, Sept. 20, 2023, 3:00 p.m.

Stormwater Advisory Board

Click here for the agenda and packet.

Thursday, Sept. 21, 2023, 3:00 p.m.

Board of Fee Appeals

Click here for the agenda and packet.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Weekly Update Sept. 11-15, 2023

Upcoming Meetings

Monday, Sept. 11, 2023, 5:30 p.m.

Zoning Board of Appeals

Click here for the agenda and packet.

Tuesday, Sept. 12, 2023, 9:00 a.m.

Infrastructure & Regulation Committee

Click here for the agenda and packet.

NOTE: The Public Safety Committee meeting previously scheduled for September has been canceled. The next Public Safety Committee meeting will take place Oct. 10, 2023.

The meetings of County Council, Council Committees, Zoning Board of Appeals, and Planning Commission are also broadcast on the Horry County Government website, and the Government Access Television Channel (Spectrum/Time Warner channel 1301 or Horry Telephone Cooperative Channel 14.

--------------------------------------------

Road Closures & Construction Updates

Motorists in all road construction areas should use caution.

We urge drivers in the area to slow down, pay attention to all road signs and traffic control devices, and drive cautiously to keep our crews safe.

For status updates on all of our current RIDE III program projects, visit our online dashboard.

---

Traffic Update: New Pattern for Myrtle Ridge Drive

Beginning Friday, Sept. 1, 2023, there is a new traffic pattern along Myrtle Ridge Drive.

Be sure to follow the updated signs and pavement markings to ensure a smooth transition.

Drivers are encouraged to exercise additional caution and patience while everyone gets accustomed to the new pattern.

---

Horry County Legislative Delegation Seeks Applicants

The Horry County Legislative Delegation is currently seeking applicants for the following boards/commissions that has vacancies, expired terms, or terms that expire in the near future:

- Horry County Disabilities & Special Needs

- Horry County Higher Education Commission

- Horry County Voter Registration & Elections Board

- One Percent Rural Fire Local Board

- SC Foster Care Review Board 15-B & 15-C

- Waccamaw Center for Mental Health Governing Board

Applications should be submitted no later than Friday, Sept. 29, 2023.

For those individuals whom are interested in serving on these aforementioned boards/commissions, please note the entire application process has changed and now will be completed digitally.

- Step 1: Constituents can now access the application via the Delegation page on the Horry County website: https://www.horrycountysc.gov/departments/delegation/boards-and-commissions/ On the right hand side of the page, there is a link to the Full Board & Commission application and background check form.

- Step 2: Please allow ample time to complete the application process in one sitting. Once the required application page is completed, constituents will receive an automated email from Horry County.

- Step 3: Constituents will also receive another email from DocuSign to complete the required background check form. Once the required background check form is completed, constituents will receive two automated emails–the first from DocuSign confirming the completion of the background check form and the second from Horry County confirming the application process has been completed.

For any questions, please contact the Delegation office at 843-915-5130 between the hours of 9 a.m. and 4 p.m. or via email at Minko.Danielle@horrycountysc.gov

Additional information about the Delegation is also available on the Horry County website.

Roads Closed, Repair Work Underway After Idalia

Horry County Government crews are actively working to assess roadways, clear debris, and make repairs where needed in the aftermath of Tropical Storm Idalia.

Over the course of Wednesday and Thursday, Idalia brought heavy rains and flooding in low-lying areas across Horry County. As a result, some roads did sustain varying levels of damage, and others still have standing water at this time.

Community members are encouraged to heed road closure and detour signage, steer clear of damaged or water-covered roadways, and use alternate routes.

To report a road or drainage issue during regular working hours, call the hotline at 843-381-8000. After-hours, use the non-emergency dispatch line at 843-248-1520.

To stay informed about local roads that may be impacted, community members can use the Horry County Road Closures map.

For information about state roads, use the SCDOT Road Conditions map.

Updates about overall Horry County work post-storm will be shared on the Horry County Government Facebook page.

(Please note, both the Horry County Road Closures map and the SCDOT Road Conditions map are actively updated by work crews on site as assessments are conducted. As such, information may change rapidly, and the minute-by-minute accuracy of the maps are not guaranteed. Use with caution.)

Weekly Update Sept. 4-8, 2023

All Horry County Government offices, except Public Safety operations, will be closed Monday, Sept. 4, 2023, in observance of Labor Day.

Normal operations and office hours will resume Tuesday, Sept. 5, 2023.

Stay safe and we will see you again soon.

--------------------------------------------

Upcoming Meetings

Tuesday, Sept. 5, 2023, 12:00 p.m.

Parks & Open Space Board

Click here for the agenda.

Tuesday, Sept. 5, 2023, 6:00 p.m.